Beckett Grading Services, a once-prominent player in sports card grading, finds itself in troubled waters amidst a perfect storm of challenges. The company’s grading numbers have taken a severe hit, with a significant decrease in card evaluations compared to previous years. This downward trend has only worsened with the legal issues surrounding Greg Lindberg, the owner of Beckett’s parent company, entangled in a massive insurance fraud scandal.

The legal troubles and financial instability brought to light by Lindberg’s unraveling schemes have cast a shadow over Beckett’s future. Revelations of mismanagement, including a $100 million loan against the company yielding only a fraction of the intended funds, have raised doubts about Beckett’s ability to recover. The looming possibility of liquidation adds to the uncertainty surrounding the company’s fate, as collector confidence continues to erode.

Despite the turmoil within Beckett, the wider sports card grading industry is experiencing a period of rapid growth. However, Beckett has failed to leverage this expansion and has instead fallen behind its competitors. Grading giants like PSA, SGC, and CGC Cards have seen increases in their market shares, leaving Beckett in fourth place. CGC, traditionally focused on TCG and non-sport cards, has even surpassed Beckett in sports card grading, emphasizing Beckett’s struggles in its core market segment.

While Beckett still holds sway in niche areas like high-grade Black Label 10s and Pristine 10s, its competitors have stepped up their promotional efforts, overshadowing Beckett’s offerings. The iconic card grading domain, once a stronghold for Beckett, is also slipping away as GemRate’s data shows a decline in grading for legendary cards like the 1952 Mickey Mantle or the 1989 Upper Deck Ken Griffey Jr.

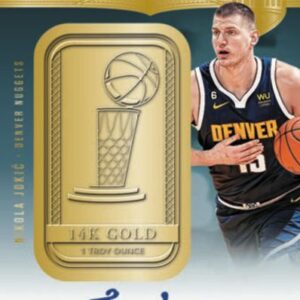

Despite these challenges, Beckett has managed to maintain relevance in certain niches. Its focus on high-end basketball cards and TCG grading has garnered steady demand in these specialized markets. Additionally, the success of grading limited-release cards like Topps Now shows potential for Beckett to regain ground in specific areas. However, the overall decline in grading volume raises concerns about the company’s long-term viability in an increasingly competitive landscape.

As Beckett Grading Services navigates through a turbulent period, the road ahead remains uncertain. Will the company be able to overcome its current challenges and revitalize its position in the industry, or will it continue its downward trajectory? With competitors gaining ground and collector confidence at stake, Beckett’s ability to adapt and innovate will determine its fate in the ever-evolving world of sports card grading.